Sales tax is a transaction tax on the retail sale of tangible personal property and certain selected services.

45 states plus the District of Columbia impose a sales tax. Traditionally, the sales tax has been assessed upon all sales of tangible personal property (TPP) unless some specific exemption applies. On the other hand, services have only been taxable when specifically listed in the statutes. For most states, if they tax any services at all, the list of taxable services is rather short.

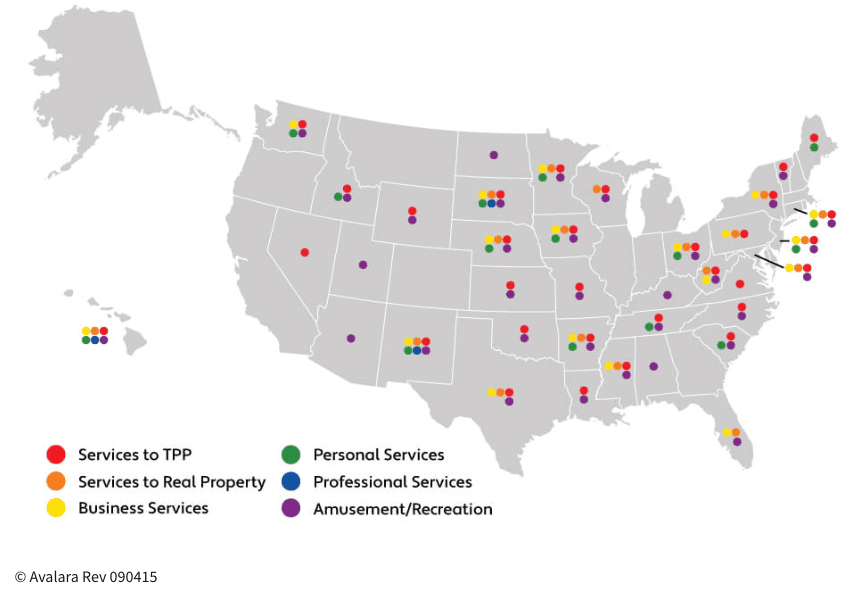

Avalara has a handy chart that shows in broad scope what states tax which types of services. You can check it out here. The states with no colored dots do not tax services at all. Of course, the NOMAD (New Hampshire, Oregon, Montana, Alaska, Delaware) states have no sales tax, so it follows that they don't tax services. Notice that California (the most populated state in the US) does not tax any services as well as several other large states including Illinois, Indiana, and Georgia.

Also notice that there are more red dots on this map than the other colors. That's because if a state taxes services, they usually tax a service like the repair of TPP. In fact, slightly more than 25 states tax TPP repair. Here's the chart:

The 7 Worst States

The 7 Worst StatesBut there are 7 states that tax a very wide range of services.

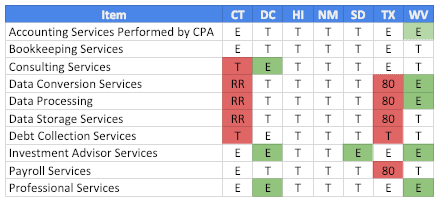

See the chart below that lists the seven states that tax not only TPP, but a wide range of services. I've chosen some of the less likely services to be taxed in order to show which states are the worst at taxing just about everything you can think of. Of particular interest to my fellow CPAs is that even our accounting services are taxed in a number of these states. Caveat emptor et provisor.

As you can see from the chart, Hawaii, New Mexico, and South Dakota tax almost everything on this list. As an aside, I once heard the director of the New Mexico Taxation and Revenue Department, declare quite proudly: "In New Mexico, if it's bigger than a breadbox, it's taxable... If it's smaller than a breadbox, it's taxable too!" DC manages to tax a lot of services too. Curiously, they tax accounting services by CPAs and bookkeeping services but not "consulting" or "investment advisor" or "professional" services.

Of course the state that stands out the most on this list is Texas! Texas is the 2nd most populated state in the US. It has no personal income tax. But its sales tax has a high rate and a broad base. Thankfully for us, accounting, professional, and consulting services are not taxed, but many more services are taxed in Texas as you can see. Connecticut is the 29th largest state in terms of population, but it also taxes a wide range of services although in some cases it offers a reduced rate (RR). Here's the chart:

If you do business in a state that taxes services, then you need to be careful about charging tax on taxable services that you sell. You don't want to miss the opportunity to charge tax when the transaction happens and then have to come back later and try to get it from your unhappy customer after you've been audited.

And, speaking of a sales tax audit, if you purchase a taxable service in a state that taxes that service, you want to make sure you accrue use tax if the service vendor neglects to charge you the tax at the time of the transaction. Doing so will save you significant penalties and interest down the road if/when you are audited.

We care about your data — privacy policy.